The Depreciation Trap: What Real Estate Influencers Won’t Tell You About STR Tax Strategy

Post 2: On Paper, It Looks Brilliant — The Allure of Bonus Depreciation

DISCLAIMER: While I can read the language of the text and my wife and I fall under the short term rental exception and material participation so our outcome might be different, I am not a CPA or Tax Attorney. Everyone's situation is different, but this is a review of tax law considerations that many laypeople assume apply—often without confirming with legal experts or tax advisors.. Before assuming you are making a good financial decision using much discussed tax strategy in real estate, consult your advisors. The outcome is not always as a simple mind would want to believe. Again, this is not tax advice—just an academic review of the written word.

📘 Post 2: On Paper, It Looks Brilliant — The Allure of Bonus Depreciation

✨ The $2M Vacation Rental and the Seduction of the Write-Off

Let’s say you purchased a $2,000,000 vacation home and placed it into service as a short-term rental after January 19, 2025. Your CPA, or someone on YouTube, encouraged you to get a cost segregation study and take bonus depreciation on the short-life assets.

Here’s what the study revealed:

$1,000,000 allocated to the structure (depreciated over 27.5 years)

$100,000 reclassified as 5-year property

$100,000 reclassified as 15-year property

You elect 100% bonus depreciation and deduct the full $200,000 short-life portion in year 1. Over the next three years, you also depreciate the structure under straight-line rules.

It feels like a win. On paper, you’ve claimed $316,364 in depreciation in just four years.

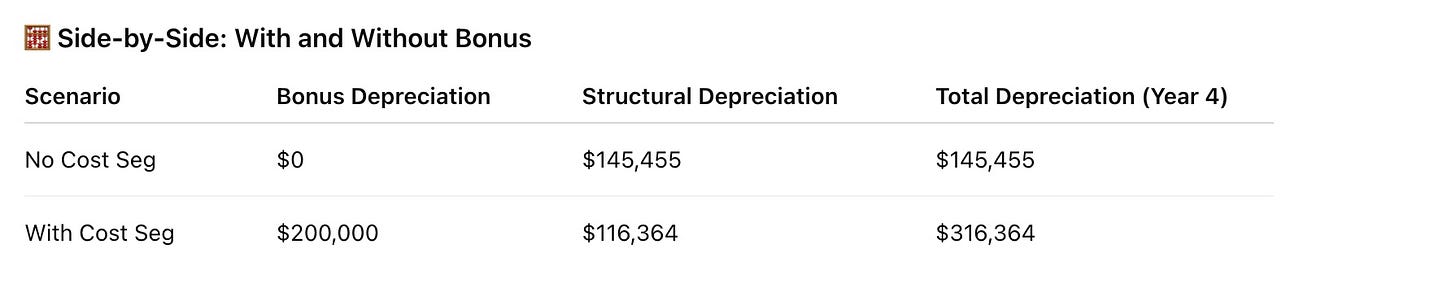

🧮 Side-by-Side: With and Without Bonus

That’s a difference of $170,909 in additional depreciation—often treated as a tax shelter.

But now let’s see what happens when you sell the property.

🔁 The Year 4 Exit — Selling at What You Paid

You sell the home for $2,000,000 — the same price you paid. No capital gain. No loss. In theory, you broke even.

But the IRS doesn’t see it that way.

Because you depreciated the property, your adjusted basis is now lower. And when basis goes down, gain goes up — even if the check at closing is the same.

Let’s see it:

You didn’t make a dime in appreciation —

…but you still owe the IRS over $100,000 in depreciation recapture.

Why?

Because you already took the deduction. And now the IRS wants it back — at 25% for the standard 27.5 years building portion, and 37% for the short-life assets if that is your tax rate at the time of sale.

🤔 Let’s Translate This

You took depreciation to reduce income, and that may have helped in the early years.

But when you sell at the same price you bought it, the IRS says:

“You still made money—because you took deductions along the way.”

And they’re not wrong. But here’s the trap:

You got the benefit of bonus depreciation at your marginal tax rate…— but now you're paying it back at 37% on the personal property portion.

No appreciation. No profit.

Still a six-figure tax bill.

🧠 So What’s the Lesson?

Depreciation isn’t free money. It’s a tool. Used right, it can be powerful. Used blindly, it can backfire.

If your plan is to buy a vacation rental, deduct as much as possible, and sell in 4 years with no appreciation?

🧨 Bonus depreciation could increase your taxes at a time when the sale does not really provide the proceeds (IE No appreciation or not enough appreciation)

😏 But You Expect the Property to Appreciate… Don’t You?

Of course you do.

No one buys a $2M short-term rental hoping it will be worth the same in four years.

So the next layer is what happens when you do make a gain.

That’s where it gets even more complicated — because now depreciation doesn’t just reduce your basis… it changes the character of your gain.

And that’s what we’ll cover in Post 3 — a deeper dive into capital gains, adjusted basis, and how depreciation recapture can erode what should’ve been a long-term win. And More……

🧩 Coming Next in the Series…

Post 3: And Then You Sell — Capital Gains & Recapture Recast

We’ll show what happens when your property appreciates — and how bonus depreciation can turn long-term capital gains into short-term ordinary tax consequences. Oh and this will get even deeper. We will talk Passive and Active participation and the ramifications on your possible tax bill.