How to Create a Life No One Sees

Seaside Florida — Why Vision Beats the Crowd Every Time

Buying Experience Real Estate: WHY TO Guide

There’s another phrase I hear constantly in real estate: “That price doesn’t make sense.”

It usually comes from people who are looking backward, not forward. They compare today’s purchase to yesterday’s comps, and if it doesn’t fit neatly in the box, they dismiss it. But the people who create value in real estate aren’t the ones chasing yesterday’s prices. They’re the ones seeing tomorrow before it arrives.

We lived this firsthand in Seaside, Florida.

Our 2017 Purchase — “You Paid WHAT?”

In 2017 we purchased 35 Tupelo Street in Seaside. At the time, it was a tired 1,300-square-foot home, nearly 35 years old. We paid $1,429,000 for it.

People looked at us like we had lost our minds. The price per square foot was ~30% higher than the prevailing average comps of homes north of 30a in Seaside. Why pay beachside pricing for a non-beachside home?

Here’s why:

At that time, there had only been three known tear-downs in Seaside’s history.

No one was thinking about a major rebuild or renewal phase.

But we were looking at the regulating plan, the urban code, the build rules.

We saw something others didn’t: Seaside was about to enter a new chapter.

📌 Vision Check

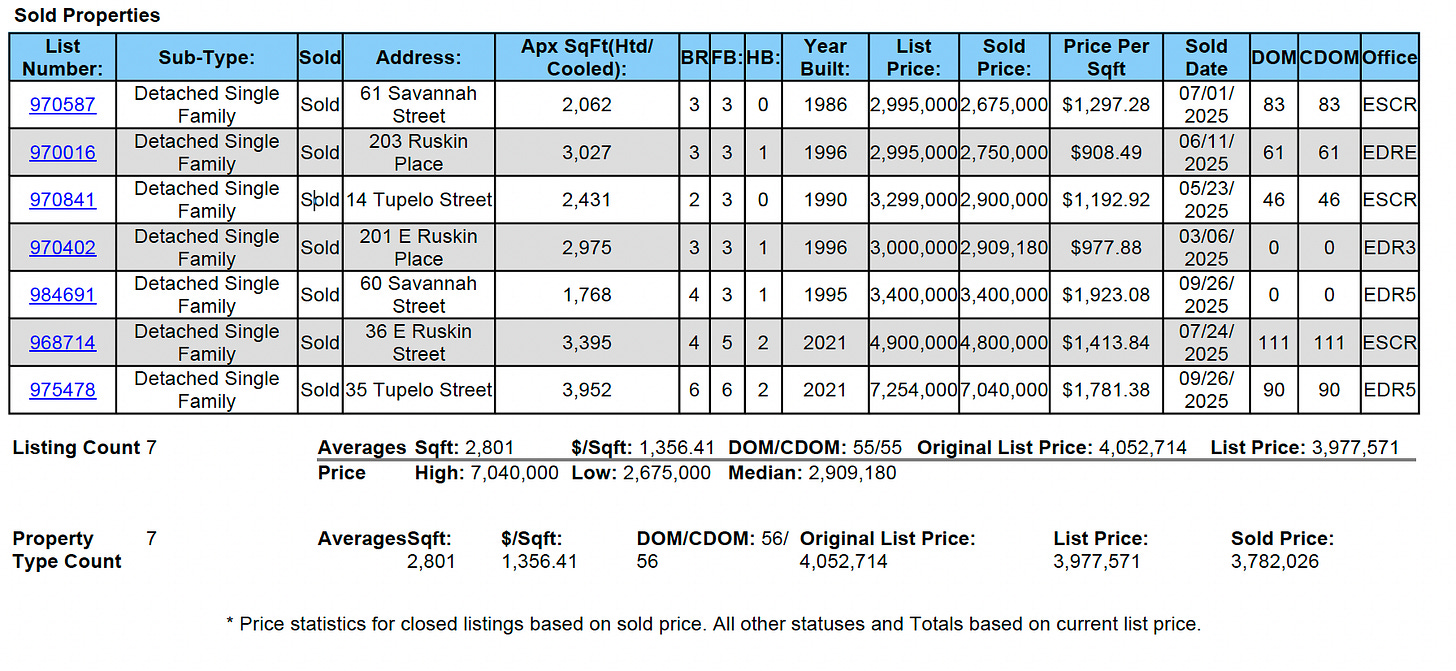

Comps tell you where the market has been. Codes, regulations, and design trends tell you where it’s going. This is where it was going 2025. Note the 60 Savannah - a wonderful updated remodel home with a pool and 35 Tupelo. Other examples in 2024 of over $1,800 per square foot are available if you want to chat. Great homes Nicely Redone.

The Plan

We asked the right questions. Could we:

Build a luxury 800-square-foot, 2-bedroom carriage house while living in the old “Tiger Paw” house?

Then move into the carriage house while building a new 4-bedroom, 3,200-square-foot main home with a two-car garage and pool?

Yes. Of the type of home 35 Tupelo is, a 22 foot maximum height lot type VI home, there will never be one bigger. It is simply not possible. 35 Tupelo will likely remain about the 18th largest home in all of Seaside, Florida out of 355 homesites. Remarkable as an opportunity.

Our purpose? To replace the Rosemary Beach home Gayle had sold, and to move on from the Seagrove home we had built together.

The metrics?

Old-home comps in Seaside (north of 30A) were running about $800 per square foot.

At 4,000 total square feet, that implied a $3.2M value.

No home north of 30A had ever sold that high — but we saw the future.

We knew new builds in 2014–2015 were already achieving $850 per square foot.

So, the math:

$300,000 for the carriage house.

$1,200,000 for the new main house.

All-in cost: about $2.9M.

Expected value: $3.4M.

That’s a projected $500,000 equity gain — plus the lifestyle upside.

📌 The Builder’s Math

Don’t ask “What’s it worth today?” Ask: “What will this be worth when it’s the right home in the right phase of the market?”

The Reality

We finished the carriage house in early 2019 and moved in.

We started the main home in January of 2020 (yes — that year), and finished in February 2021. By then, demand in Seaside and across 30A was unlike anything we’d ever seen.

Fast forward to 2025: we’ve sold that home for over $7 million.

Did we “time the market perfectly”? No. Did the market help us? Sure. But the real point is this: the decision in 2017 to pay $1.429M for a dated house no one understood was not about chasing comps. It was about vision.

By 2021, Seaside was entering its rebuild phase. New homes and carriage houses were underway. By 2025, there are nine new homes under construction. A full renewal wave.

We were simply ahead of the curve. And we still are.

The Trap of Following the Crowd

Imagine if we had waited. If we had said:

“Let’s wait until the comps justify it.”

“Let’s see if the market proves itself first.”

We never would have bought. We never would have built. We never would have sold at $7M.

Waiting for yesterday’s data to justify tomorrow’s vision is the surest way to always be late.

The Takeaway

Real estate value is created by vision, not hindsight.

When we purchased 35 Tupelo in 2017, people thought we were crazy. Today, those same people see Seaside’s rebuild wave fully entrenched. But the opportunity wasn’t in 2025 — it was in 2017, when conviction was required.

That’s the difference between leading the market and following it.