Lies, Damn Lies, and Statistics

Episode 3: When the Numbers Don’t Matter (and Why That Scares Agents)

Previously on Lies, Damn Lies, and Statistics

Episode 1 introduced the foundation: how averages and medians behave differently, why small sample sizes create misleading volatility, and why trend lines matter more than point-to-point comparisons. Using card decks and apples as analogies, it showed how randomness masquerades as truth when agents misuse statistics.

Episode 2 shifted to affordability in financing-dependent markets, demonstrating that price increases since 2019 have far outpaced income growth, and that minor rate cuts barely move the needle on monthly payments. The conclusion: housing affordability is primarily a function of prices versus incomes, not wishful thinking about interest rates.

Introduction

In much of housing, numbers rule. Affordability is calculated as a function of price, income, and mortgage rates. When rates rise, payments climb, and demand cools. When rates fall, affordability improves, and demand revives.

But in luxury markets, particularly second-home markets on the coast, this framework breaks down. Buyers here are rarely constrained by debt-to-income ratios or pre-approval letters. Their calculus is not about “can we afford it” but “do we want it.”

And that changes everything about how statistics should — and should not — be applied.

The Failure of the Financing Lens

In the financing-dependent segment of the market, interest rates operate like gravity. A one-point rise in mortgage rates can cut affordability by tens of thousands of dollars. Prices shift in line with what the average household can borrow.

But this logic dissolves when the buyer pool is wealthy. The $5 million home near the Gulf does not trade because the Fed trimmed a quarter point. Nor does the $18 million Gulf-front luxury home.

They trade because a family envisions Thanksgiving dinners on the terrace, or because a buyer believes their children will measure childhood summers against the backdrop of a particular dune.

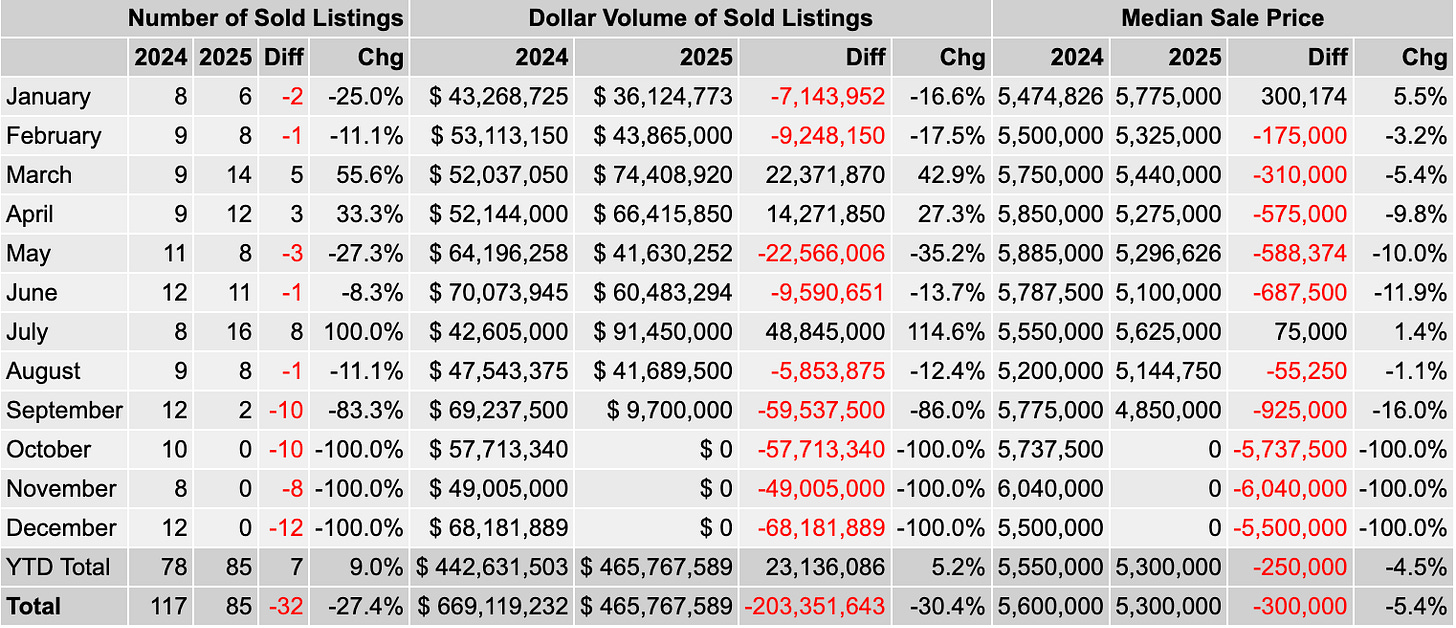

📊 Proof Point: The $5M Near-Gulf Market

Median pricing statistics fail to capture why these homes trade. They don’t move in sync with interest rates or mortgage math — they move when lifestyle buyers decide the moment is right. Still this is telling. Worry about other things in the 4.5 to 8 million dollar range seems to be holding this market back on pricing while still we are up 9% in homes sold.

Valuation as Subjective Utility

Economists would call this “utility.” In luxury markets, it looks more like pleasure.

A beachfront property offers sunsets visible from the master bedroom.

A courtyard design promises privacy for extended family gatherings.

A particular town carries cultural cachet — the right zip code, the right neighbors, the right club.

None of these are captured in a mortgage calculator. These are stories. And in the luxury market, stories set price. Is this the point at which it is about the heart now here on 30A? Probably

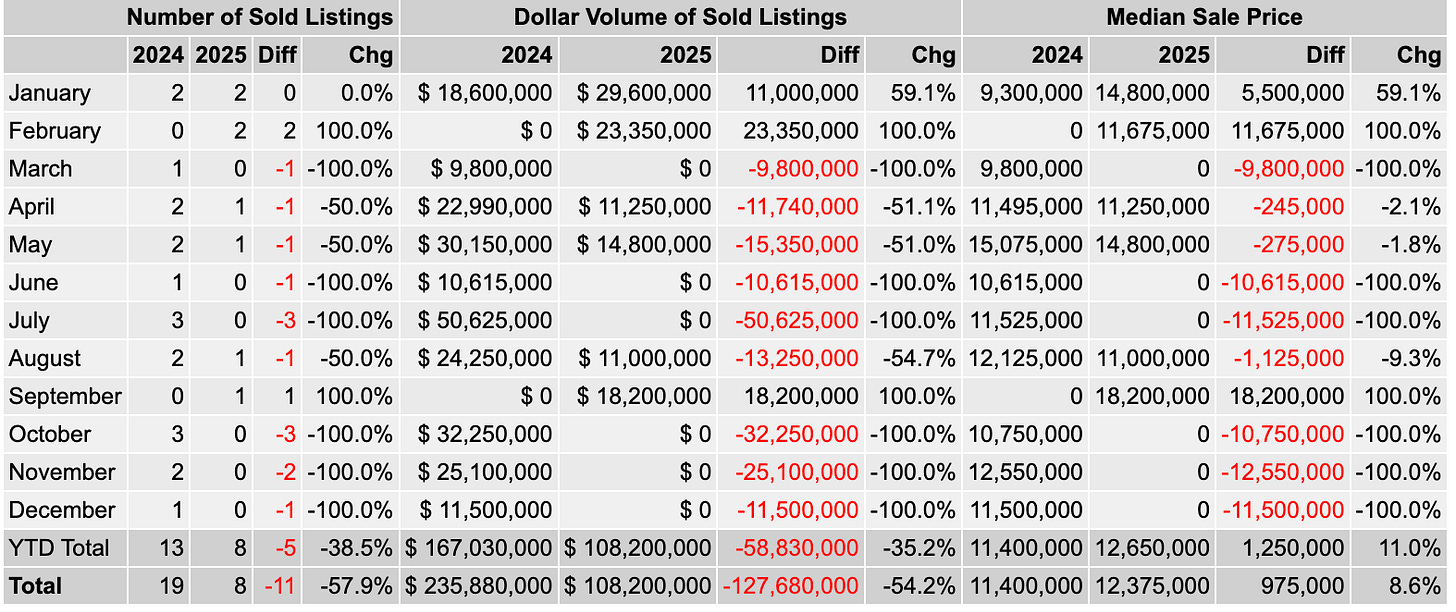

📊 Proof Point: The $10M Luxury and Gulf-Front Market

Median charts may show peaks and troughs, but they miss the human element. A one-of-a-kind property trades when a motivated buyer decides the story matters more than the statistic. Here it becomes clear that this market is a bit down on units sold (law of small and large numbers) but the pricing is on balance up 11%. Remember our first primer on the median card trick. But this is telling. Luxury is about memories. This market is doing well.

The Statistical Mirage

This is why medians and averages often mislead when applied to the luxury tier. They measure activity but not intent.

A 14% decline from peak might be a headline number. But the buyer who has been waiting five years for a house on a specific street to trade will shrug at the statistic. For them, the opportunity is unique, unrepeatable, and immune to trend lines.

The “average” family income or “median” neighborhood sale price are simply irrelevant in this space. The true metric is motivation: how badly a buyer wants to embed their story into a place.

Conclusion

The financing market and the luxury market obey different logics. One is governed by ratios of price, income, and interest rates. The other is governed by psychology, memory, and desire.

This is what most agents miss when they apply broad statistics to the very top of the market. The top of the market is not a price per square foot market. That measure is the lagging measure from all other things that led to the purchase choice. Medians, averages, and year-over-year comparisons may work in the financing world, but they collapse in the face of wealth.

In luxury, numbers do not tell the story. The story tells the numbers.