Seaside, Florida Economics: Renewing a Town by Example

By Example I mean We are Doing it and We have Done it.

Seaside, Florida stands as one of the most distinctive communities in America — a living symbol of New Urbanism and intentional design. Born from a hand-drawn plan and a visionary code crafted by the founder and a handful of pioneering architects, Seaside’s DNA is rooted in simplicity, proportion, and purpose. The early town builders — artisans like Benoit Laurent, Berl Elliott, Peter Horn, and Alan Ficara — translated sketches from Robert Orr and others into structures that shaped not just streets, but a way of living. The Rosewalk is a prime example of what showed the world the sense of place Seaside was meant to be.

Realizing the designs of Robert Orr, Greg Jazayeri, Tom Christ and Associates, the late Dawn Thurber and her final design, and countless others including Kelly May of Southern Lines Designs, Seaside continues to inspire both the original architects and a new generation of visionaries. Builders like Daniel Cole, LPKK Investments, Huff Homes, and Dune Construction are redefining Seaside’s next chapter, creating homes that respect the town’s founding ideals while embracing modern craftsmanship.

The renewal of Seaside is not speculative — it’s deliberate. Sometimes quiet, sometimes bold, but always guided by the same DNA that built the first homes here. It’s a renewal of standards, of intention, and of the idea that great design and disciplined economics can coexist. For those not fully noticing, in addition to the more than 26 new homes in the past decade, the acceleration is well underway — with eight homes (as of 2025) currently under construction.

What if we see just six new homes a year for the next ten years? That’s not outside the realm of possibility. That would mean at least 60 new homes yet to come in one of the most coveted communities on the coast.

The Baseline Sale

A recent sale of 35 Tupelo Street — a 4,000 sq. ft. master-crafted home designed by Robert Orr and built by Richard and Gayle Jabbour — closed at $7,040,000, fully furnished, with a commanding Gulf view and the level of finish that now defines Seaside’s upper tier.

This was the Jabbours’ second new-construction home in Seaside. The sale serves as both a benchmark and a proof of concept: buyers will pay a premium for homes that are new, contextual, and executed with architectural integrity.

The total build for the home was $1,889,000 in 2025 costs, and the furnishing cost for this project was $218,000 — inclusive of all finishes, design fees, and builder overhead — for a total cost of approximately $2,107,000. After applying a 5% agency commission and a 0.7% Walton County stamp tax, the net sale proceeds come to $6,563,520, which defines the economic ceiling for comparable new builds in Seaside today on a lot governed by this Urban Code and Regulating Plan.

Namely, this is the Lot Type VI of 22 feet height to the ridge with a tower above, along with the execution of a carriage house per the entitlement sharing rules that prevail in Seaside I.

This sale is the anchor point for evaluating replacement cost, residual lot value, and achievable returns across the town’s next generation of homes.

The Framework

We are not looking at this through the lens of leverage, financing, or speculative emotion. The market only deals with the economics of activity, not the ego of it.

Like anyone else, I’d love to say I earned a 78% return because I used leverage. In truth, that home was built when Seaside land values were very different. I’ve updated the math here to reflect today’s conditions so we can determine current land and site values with accuracy.

A home is only going to yield the nominal dollar return it yields. The market never pays you for your financing choices. If you chalk up interest charges, that’s fine, but it is only a capital return mechanic and not an economic value generator. Said more simply, if you pay hundreds of thousands in interest on loans, the price of the home will not increase just because of that. This is the biggest mistake builders, investors, and many others make in evaluating these opportunities. They confuse Cowboy Capitalism with economic reality, focusing on ROI rather than the nominal dollars a project will yield.

This is a cash-based economic reality check — the difference between being an investor and being a cowboy. This is not to say that once grounded in reality leverage should be avoided, but I have seen too many people lose money because they were not grounded first in economics. They were focused on a high ROI based on leverage without considering the facts on the ground first.

Leverage distorts understanding. Cash reveals truth. We’re talking about what a property is worth — not what someone can temporarily afford to overpay for with cheap credit or by leveraging a build to inflate ROI.

Context matters: we lived in 35 Tupelo for eight years, and we’re currently executing a Pensacola build. 35 Tupelo was completed in 2021 at cost. We have updated that cost to what would be experienced today to make sure we evaluate future opportunities properly. With that unique understanding, we have embarked on a new home on Pensacola Street with this clear economic lens — so what did we pay for the location at 22 Pensacola, and is it justified for a rate of return?

That lived experience informs our standards, cost discipline, and the lens of this analysis. While we cannot say we will stay in any home we build forever, we can say that we will very likely stay in Seaside until we no longer can do so due to age or other undeniable life factors.

Will we stay in our Pensacola build forever? Maybe. But the more important issue here is that we believe in what we say not only emotionally because of the community but economically because of reality.

It is a reality that only a very few people have lived here in Seaside building more than a few homes like us. I am happy that includes me and Gayle — now working on our third home here in the rarified air of those who live in Seaside still and have built multiple homes to honor the community.

We live this in Seaside: we will build when the economics support it, and we’ll hold off when they don’t. The analysis below is that filter. Every calculation, every return percentage, is done from the perspective of clear-eyed economics — not emotion or assumption.

The Cold Hard Math

For this illustration, the sale price is fixed at $7,040,000. After a 5% agency commission and a 0.7% stamp tax, the net sale proceeds are:

Net Sale Proceeds = $7,040,000 × (1 − 0.05 − 0.007) = $6,563,520

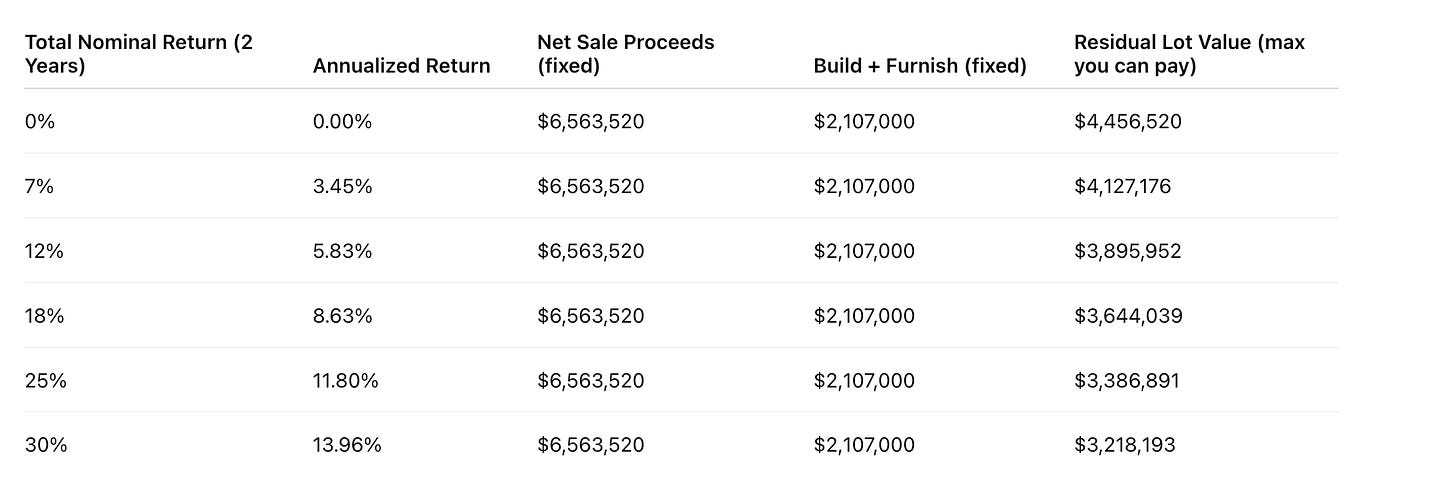

Build + contractor fee + furnishings are fixed at $2,107,000 for a home of comparable stature to 35 Tupelo. For a two-year project, the residual lot value (what an investor can pay for the dirt) that still achieves the required annualized return (r) is:

Residual Lot Value = Net Sale Proceeds / (1 + r)^2 − Build & Furnish Cost

Who Would Do 0%, 7%, 12%, 18%, 25%, or 30%?

0% Return: The sentimental homeowner — the “I just want to live here” crowd. This is lifestyle-driven, not economically rational. In Seaside, I would argue this is a more powerful force than in Old Seagrove or similar areas.

7% Return: The cautious renovator or second-home buyer telling themselves they’ll “break even” after enjoyment. They are occupiers with upside, not true investors.

12% Return: The disciplined small developer. Knows their numbers, values time and capital, and accepts moderate risk for solid reward.

18% Return: The professional builder-operator. Understands execution risk, carries overhead, and expects market cycles. This is sustainable for professional redevelopers like us.

25% Return: The opportunist or contrarian who buys mispriced land or older homes, times cycles perfectly, and takes calculated—but rare—shots. These projects exist, but they’re few and far between.

30% Return: The rare market outlier — exceptional timing, unique lot, or unusual value creation. Usually luck, inside knowledge, or the early bird catching the next trend. Often this occurs when the overall market is under economic stress or uncertainty. However, that does not mean that prices must fall or will continue falling — the smarter player anticipates inflection points. Seaside, right now, is at an inflection point.

The Cowboy Capitalist and the Mirage of Leverage

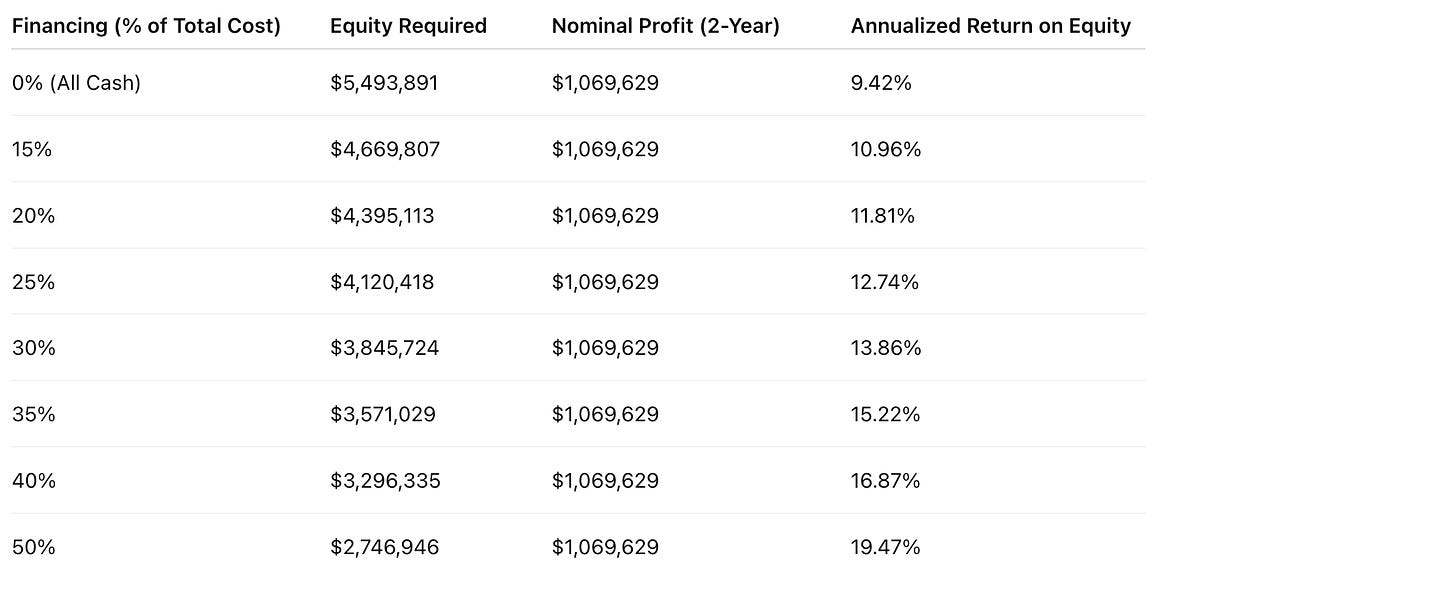

For the leverage illustration, we’re now using the 25% nominal return case as the benchmark — that one implied a land basis of $3,386,891, the figure that most closely aligns with a motivated investor-builder confident in their ability to execute efficiently. This person is paying a contractor fee embedded in our numbers.

That gives us a realistic total project cost:

Build + Furnish: $2,107,000

Land: $3,386,891

Total Cost (including land): $5,493,891

With net sale proceeds fixed at $6,563,520, the nominal profit (2-year) becomes:

Profit = $6,563,520 − $5,493,891 = $1,069,629

This 25% nominal return scenario is the cowboy’s comfort zone — the sweet spot for the hands-on investor who manages crews, controls timelines, and lives for the process. The return is high enough to justify the risk but still realistic. The cowboy bets on speed, cost control, and optimism — believing that skill, design quality, and timing can turn a good project into a great one.

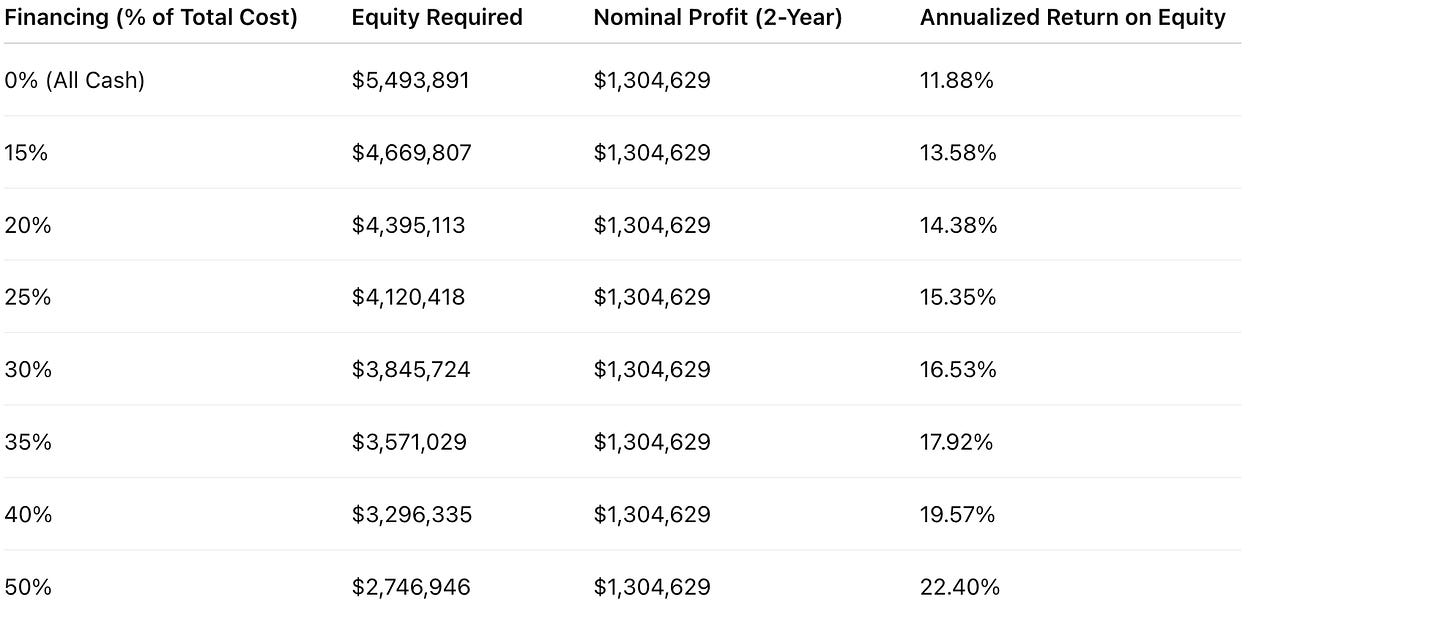

When the Cowboy Is His Own Sheriff

Now, let’s take the same scenario and adjust one key element — the cowboy is also his own sheriff. In this case, he’s not paying a general contractor or builder fee. That fee, which averaged roughly $235,000 in the prior example, now stays in his pocket.

That adjustment raises the nominal profit from $1,069,629 to $1,304,629. With the same total project cost of $5,493,891, the all-cash return increases from 9.42% to 11.88% over two years, before even considering any leverage.

This is the builder-developer archetype — the true cowboy who not only takes the risk but controls the execution. By removing the builder fee, he effectively captures both margins: the construction spread and the ownership return. The danger, of course, is that his time, overhead, and opportunity cost are now fully embedded in the deal. It’s higher reward, but also higher exposure if the project slows or costs overrun.

The Takeaway

When sellers in Seaside hold out for fantasy prices based on what their neighbor “heard” a home sold for or a lot is worth, they ignore what actually drives profitability. More critically in Seaside, owners often fail to recognize that each lot type is different — and the amount of home that can go on each lot is different.

Of the Lot Type VI homes, I dare say that, relatively speaking, there will never be a more highly valued home than 35 Tupelo. There are a number of reasons why that’s true. And as an economist, relatively means a lot. A home may sell for more ten years from now, but in today’s dollars, that home is economically “it.” So, we can benchmark all other Lot Type VI homes against that one.

To be clear and open — if you can find a lot in Seaside where, on a Lot Type VI (22-foot-tall) home site, you can build a luxury home in the Seaside vernacular and pay less than $3,386,891, then you are probably doing the right thing. But you must be aware of subtle differences in those lots. Location to the beach and width matter. Some Lot Type VI homes are on 35- to 42-foot-wide lots. Those have limited upside potential and are not likely rebuild candidates. Instead, they might be remodeled, like 15 Natchez.

We paid $3,111,000 for our homesite at 22 Pensacola. Our build cost is projected at all-in, meaningfully under $2,000,000. Of course, this is a living home for us. But still, the prevailing retail value of that home will easily exceed $6,659,000, though it will not eclipse 35 Tupelo because of lot dimensions and scale.

The market doesn’t care what someone thinks their lot is worth or about the home that’s clearly out of step with the town’s trajectory. So for those paying a premium for an older home in Seaside, that may be wise — or it may be nostalgia. In short, in Seaside, where rebuild is clearly needed due to the age of most homes, be careful what you pay for a home, because unless you are recrafting a new one, your exit strategy over time will depend on a smaller and smaller pool of nostalgic buyers.

We measure our work by that simple reality — the math doesn’t lie. But Seaside has never just been about math. It’s about stewardship — about building with truth, integrity, and respect for the pattern that made this town what it is. If renewal comes from that place, the economics will always follow.

Why This Matters Beyond Seaside

Economics is economics. Whether it’s Seaside, Old Seagrove, Rosemary, or a town far from the coast, the math of value creation doesn’t change. Replacement cost, residual lot value, and achievable return are universal measures — they reveal truth in every market, if you’re willing to look.

But community renewal takes more than spreadsheets. A town renews only when it can still call to the heart — when its design, walkability, and human scale still make people feel something. That’s what Seaside continues to do. It reminds us that great places are built on numbers and nurtured by emotion — and the rarest achievement of all is when both align.