The Depreciation Trap: What Real Estate Influencers Won’t Tell You About STR Tax Strategy

The Taxman cometh and Right Soon

DISCLAIMER: While I can read the language of the text and my wife and I fall under the short term rental exception and material participation so our outcome might be different, I am not a CPA or Tax Attorney. Everyone's situation is different, but this is a review of tax law considerations that many laypeople assume apply—often without confirming with legal experts or tax advisors.. Before assuming you are making a good financial decision using much discussed tax strategy in real estate, consult your advisors. The outcome is not always as a simple mind would want to believe. Again, this is not tax advice—just an academic review of the written word.

📘 Post 1: The Rules of the Game — Depreciation Elections and Recapture 101

🏗️ What Is Depreciation — and Why Do Real Estate Investors Love It?

Depreciation is the silent tax engine of real estate investing. On paper, it lets you deduct the “wear and tear” of a property—even if the property’s value is going up. For U.S. residential property used in business (including vacation rentals), the IRS requires you to depreciate the structure over 27.5 years using straight-line depreciation.

If you buy a $2,000,000 property and allocate $1,000,000 to the building, you deduct about $36,364 per year — whether or not the home is falling apart.

Depreciation reduces taxable income now (perhaps only to a point)... but creates consequences later.

🔧 Elections You Can Make — and Why People Push Bonus Depreciation

There’s a way to supercharge your tax deduction: cost segregation. It reclassifies parts of the home (like cabinets, appliances, and landscaping) as shorter-life property — eligible for accelerated depreciation and even bonus depreciation under IRC §168(k).

You’ve probably heard someone say:

“We took $200,000 in bonus depreciation this year and wiped out all our income!”

Sure. But what did that actually do? This is where rules matter. Following rules also matters. We do not discuss breaking rules in any forum.

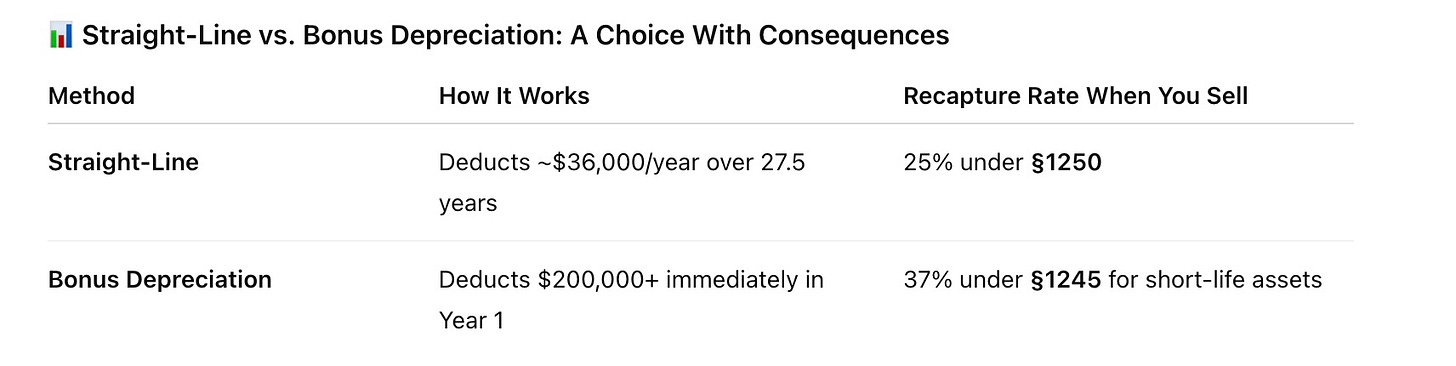

📊 Straight-Line vs. Bonus Depreciation: What the IRS Allows

Here’s what matters:

📌 The IRS gives you a choice—but expects you to repay part of the benefit when you sell.

🧾 What the IRS Assumes (Whether You Like It or Not)

This is a critical rule almost nobody on YouTube mentions:

The IRS assumes you claimed depreciation — even if you didn’t.

It’s called the “allowed or allowable” doctrine. If you could have depreciated something, the IRS will count it against you when you sell.

📎 Treasury Reg §1.1250-1(d)(4)

Translation: You can’t skip depreciation to avoid recapture later.

You’ll still owe it.

🔥 Recapture — The Tax Waiting at the End - Good, Bad, Ugly?

When you sell the property, the IRS requires you to “recapture” the depreciation you took (or could have taken). This is not capital gains tax — it’s ordinary income tax for bonus depreciation, or 25% recapture for structural depreciation.

Here’s the twist: if you took bonus depreciation on short-life assets via cost segregation, that gets recaptured at your full income tax rate — up to 37%.

📉 You turned at least some of a 20% capital gain into a 37% tax bill... because you wanted a deduction today. The rest is ordinary income.

Oh, but if you think that’s the only twist — stick with this series.

Because what if — just what if — you aren’t even allowed to use that bonus depreciation in the year you hope to take it?

What if you’re limited by IRS rules and it turns into a suspended passive loss you can’t touch — a paper deduction that sits there forever, maybe never offsetting income at all? Remember, if you take the bonus depreciation you are asserting that you are a material participant.

💣 Surprise: This happens more than you think.

And your agent? The one who told you this was a smart move?

They weren’t a tax attorney.

You just assumed you could do something… because someone else did. Remember not everyone follows the rules. Not Following tax rules? Big Risk…..

🧠 So, What’s the Game?

At the surface, depreciation sounds like a brilliant tool — and it can be.

But it’s only the first inning of a long tax game.

You need to know:

What election you made

What the IRS assumes

And what tax is waiting for you when you sell

🧩 Coming Next in the Series…

Post 2: On Paper, It Looks Brilliant — The Allure of Bonus Depreciation

We’ll walk through a real example: a $2M property, four-year hold, and what the numbers look like when you go big with bonus depreciation.

Richard, this is a brilliant piece you have written. Thank you for putting it in simple language to understand. I look forward to reading the rest of this series.