The Depreciation Trap: What Real Estate Influencers Won’t Tell You About STR Tax Strategy

Post 4: The STR Exception — Rental… or Business?

DISCLAIMER: While I can read the language of the text and my wife and I fall under the cshort term rental exception and material participation so our outcome might be different, I am not a CPA or Tax Attorney. Everyone's situation is different, but this is a review of tax law considerations that many laypeople assume apply—often without confirming with legal experts or tax advisors.. Before assuming you are making a good financial decision using much discussed tax strategy in real estate, consult your advisors. The outcome is not always as a simple mind would want to believe. Again, this is not tax advice—just an academic review of the written word.

📘 Post 4: The STR Exception — Rental… or Business?

🏡 The Label Matters

Most people assume rental real estate is… well… rental real estate.

But that’s not how the IRS thinks.

If you own a short-term vacation rental, there’s a good chance your property isn’t legally considered rental activity at all.

And that opens up a whole different set of rules — especially around what income is passive, what losses you can claim, and how depreciation behaves.

Instagram Detour

You really should Check out Our “Elements of” Series featuring popular communities along 30A. It is a different way to look at things. More Vibe centric and more style of the life you can have.

📏 The IRS Rule — 7 Days or Less

Under Treasury Reg §1.469-1T(e)(3)(ii)(A), the IRS states:

If the average period of customer use is 7 days or less,

the activity is not treated as a rental activity under passive activity rules.

Why does that matter?

Because it means:

Your vacation home isn’t "rental real estate" — it’s a business

But it’s still subject to the passive activity loss rules under IRC §469

And the only way to unlock deductions like bonus depreciation is through material participation

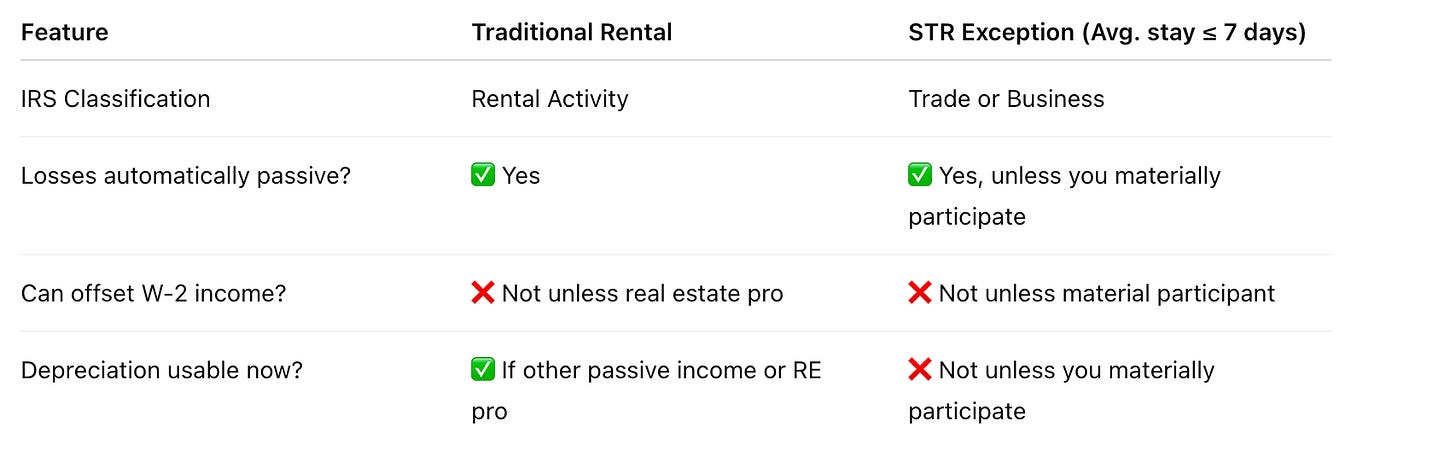

⚖️ Rental vs. Business — What’s the Real Difference?

🧠 This Catches People Off Guard

Many real estate investors hear “short-term rental” and think that somehow gets them more tax flexibility.

But in truth, it often reduces your flexibility — especially if you’re not active in the business.

Bonus depreciation can generate a massive paper loss.

But unless you materially participate, that loss becomes suspended — locked away as a passive loss carryforward.

You can’t use it to offset:

Your W-2 income

Your spouse’s business income

Your investment or dividend income

Unless you’re in another passive activity with income (rare), you’re just… stockpiling losses.

🤔 So Why Does This Matter?

Because the classification of your STR determines everything about how depreciation and losses are treated:

You can’t use real estate professional status to claim STR losses

You must materially participate (we’ll cover that in Post 5)

You may owe recapture tax later on losses you never got to use

This is the foundation of everything that goes sideways in STR tax planning:

People apply rental rules to a business… and end up surprised.

📌 Summary: Your Short-Term Rental Is a Business

If your average guest stay is 7 days or less, your STR is not rental activity

It’s a business activity — but it's still passive unless you materially participate

That means depreciation doesn’t help you now unless you meet participation standards

And if you don’t? You still owe recapture tax when you sell — even if you never used the deduction

🧩 Coming Next in the Series…

Post 5: But You Didn’t Participate — The Passive Loss Trap

We’ll go deeper into the material participation tests, show how easy it is to fail them without realizing it, and explain how all those bonus depreciation deductions might just end up in suspended limbo.