The Depreciation Trap: What Real Estate Influencers Won’t Tell You About STR Tax Strategy

Post 8: What If You Can Use the Loss?

DISCLAIMER: While I can read the language of the text and my wife and I fall under the short term rental exception and material participation so our outcome might be different, I am not a CPA or Tax Attorney. Everyone's situation is different, but this is a review of tax law considerations that many laypeople assume apply—often without confirming with legal experts or tax advisors.. Before assuming you are making a good financial decision using much discussed tax strategy in real estate, consult your advisors. The outcome is not always as a simple mind would want to believe. Again, this is not tax advice—just an academic review of the written word.

📘 Post 8: What If You Can Use the Loss?

Real Estate Professionals and the Power of Participation

🔓 Flip the Trap: What If the Loss Isn’t Suspended?

Let’s flip everything we’ve discussed so far.

You understand how depreciation works.

You know the risks of passive treatment.

You’ve read about recapture, suspended losses, and the STR exception.

But here’s the question:

What if you’re in real estate…

…and you do materially participate…

…and your STR losses aren’t suspended?

This is where depreciation becomes real tax strategy — not just theory.

🧠 The STR Material Participation Loophole — Recap

Under the Short-Term Rental exception, your property is not a rental activity if the average guest stay is 7 days or less.

This means:

You don’t have to qualify as a “real estate professional” under IRC §469(c)(7)

You can deduct STR losses against W-2 or active income

But only if you pass one of the IRS’s material participation tests

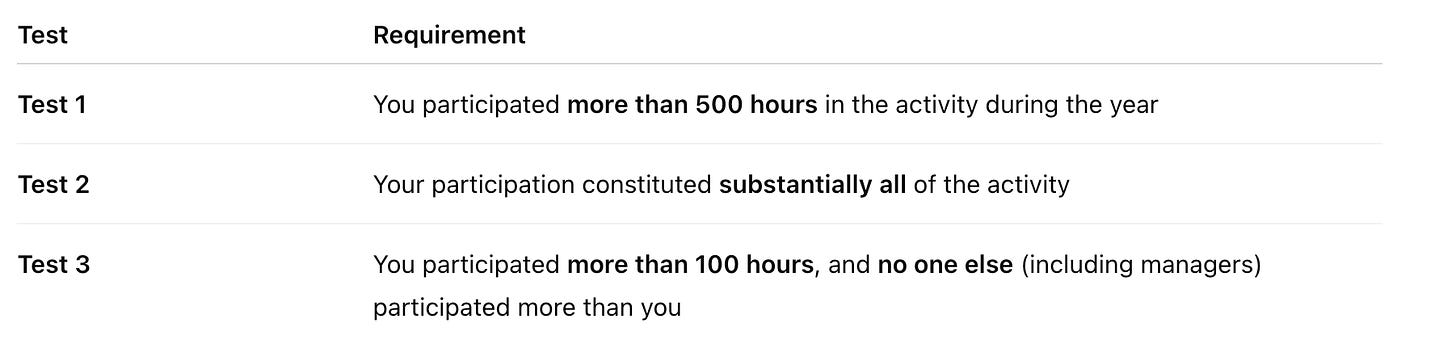

Let’s spell them out again:

If you pass any of these, your STR losses are non-passive and fully deductible against ordinary income.

🏢 But What If You’re a Real Estate Professional?

Now let’s go one level up.

If your primary profession is real estate, you may be eligible for the real estate professional status (REPS) under IRC §469(c)(7).

This applies to:

Brokers

Realtors

Developers

Property managers

Flippers

Some builders

If you qualify, you can deduct losses from any real estate activity — not just STRs — against active income. Including W-2, commissions, and other business income.

🔍 How Do You Qualify as a Real Estate Professional?

To claim REPS, you must meet two main tests:

More than 750 hours spent in real property trades or businesses in which you materially participate, AND

More than half of your total working time spent in those same real property activities

This is evaluated annually. And yes — you must materially participate in each activity (or group of activities) to deduct losses from it.

So if you’re a full-time realtor or property manager and you run a short-term rental, you may be able to:

Qualify as a real estate professional, AND

Use STR or long-term rental losses immediately, including bonus depreciation

💥 Real Example: The Agent With the STR

You’re a realtor. You make $250,000 in commission income.

You buy a short-term rental in Florida. You average 3-day stays. You self-manage.

You qualify for real estate professional status.

You get a cost segregation study that allocates:

$200,000 in 5/15-year property → taken as bonus depreciation in Year 1

You now have a $200,000 paper loss.

And you can use it.

Not suspended.

Not carried forward.

Not deferred.

It offsets your $250,000 in active income — reducing your tax liability in real time.

Depending on your marginal bracket, that might save you $74,000 or more in one year.

⚠️ But You Must Prove It

Both REPS and material participation require documentation. That includes:

Time logs

Property records

Booking calendars

Email logs

Mileage or expense breakdowns

Evidence that no manager did more than you

This isn’t “check the box and move on.”

The IRS has successfully challenged dozens of flimsy REPS claims. If you want to do it, do it clean.

🔄 The STR + RE Pro Combo: A Tax Advantage Few Use Correctly

Most agents don’t realize:

They’re already in real estate

They may already materially participate in one or more properties

They’re one spreadsheet away from using bonus depreciation to directly reduce their tax burden

And yet most still get advice from TikTok and overconfident CPAs who don’t read §469 closely.

📌 Summary: When You Can Use Bonus Depreciation

If you:

✅ Own an STR with stays under 7 days

✅ Materially participate

✅ Or qualify as a real estate professional

✅ And have ordinary income to offset...

Then bonus depreciation is not a trap — it’s a power move.

But only if you do it right. There are tons of twists and turns….I point you to the road but I am not a tax advisor. Talk to a pro but be careful and informed. Risk and Reward!