The Depreciation Trap: What Real Estate Influencers Won’t Tell You About STR Tax Strategy

Post 3: And Then You Sell — Capital Gains & Recapture Recast

DISCLAIMER: While I can read the language of the text and my wife and I fall under the short term rental exception and material participation so our outcome might be different, I am not a CPA or Tax Attorney. Everyone's situation is different, but this is a review of tax law considerations that many laypeople assume apply—often without confirming with legal experts or tax advisors.. Before assuming you are making a good financial decision using much discussed tax strategy in real estate, consult your advisors. The outcome is not always as a simple mind would want to believe. Again, this is not tax advice—just an academic review of the written word.

📘 Post 3: And Then You Sell — Capital Gains & Recapture Recast

📈 Your Vacation Rental Just Appreciated — Now What?

Let’s revisit the same scenario from Post 2. You bought a $2,000,000 short-term rental, took bonus depreciation of $200,000 on short-life components, and also claimed straight-line depreciation on the structure.

Now let’s assume a new twist:

You sell in Year 4 for $3,000,000.

Bravo. You made a million-dollar gain.

But here’s the problem…

🤨 Not All Gain Is Created Equal

Depreciation doesn’t just lower your basis — it relabels your gain when you sell.

Here’s the breakdown:

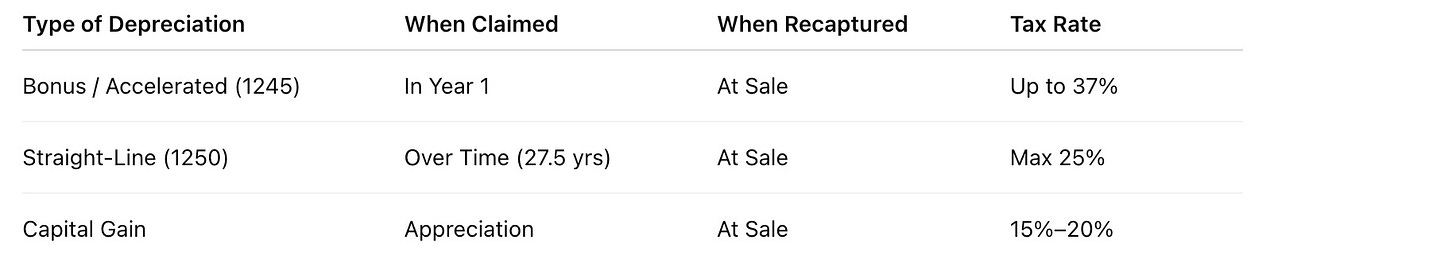

Any gain up to the amount of depreciation taken is recaptured

Short-life asset depreciation (bonus depreciation) is recaptured under §1245 — taxed as ordinary income (up to 37%)

Structural depreciation is recaptured under §1250 — taxed at 25%

Everything else? Taxed as long-term capital gain — typically 15% or 20%

For math and ease we ignore the 3.8% ACA Tax applied to all of gains for most wage earners that buy expensive vacation rental properties.

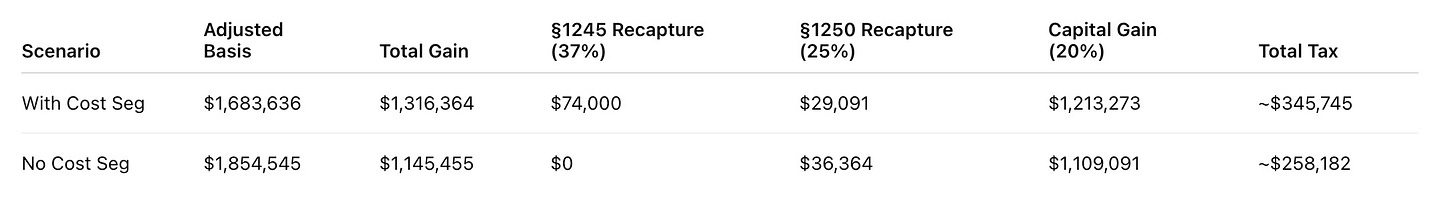

🧮 Let’s Lay Out the Numbers

You depreciated:

$200,000 bonus depreciation (5- and 15-year assets → taxed at 37%)

$116,364 straight-line depreciation on the structure (→ taxed at 25%)

You now sell for $3,000,000.

🔍 What Just Happened?

Let’s assume your income puts you in the highest bracket:

The bonus depreciation you took?

You now owe $74,000 in tax on that at 37%.The structural depreciation?

Another $29,091 in recapture at 25%.Only the remainder of the gain — what’s left after depreciation recapture — gets taxed at the preferred capital gains rate of 20%.

📉 This Is What “Recast” Means

You thought you had a $1.3M capital gain.

But nearly $300,000 of it gets recast as ordinary income or 25% recapture and bonus recapture at up to 37%— and taxed accordingly.

You traded some long-term treatment for short-term shelter… and now you’re paying it back at a premium by using bonus depreciation. Is this a good idea? Well there is a lot of math involved in that and you are probably asking, “but I am never gonna sell it or I am always gonna do a 1031 sop what difference does this make?” Famous last words. Is it always a good idea to buy things and tuck away money you can never use to enjoy life? Maybe not.

Is it always wise to tuck money into something you can’t touch?

To earn limited cash flow today, just to leave it untouched for your estate?

Was that the goal—or just the outcome?

Are the benefits of this kind of strategy good enough for you? That is up to you and your investment advisory staff, CPA and Tax Attorney and not me. (P.S. I was once one of these in my career and have all three now working with me so while I am not advising…I am not guessing either - “Philosophy is the talk on a cereal box”)

🧠 So What’s the Big Picture?

Bonus depreciation isn’t just about front-loading deductions.

It’s about changing the way your exit is taxed.

Let’s break that down:

And guess which ones most CPAs and YouTube strategists brag about helping you accelerate?

The ones taxed highest on the way out.

📌 Summary: Bonus Depreciation Has a Back End

You got a bigger deduction early.

But now…

You owe more in recapture - Maybe it is worth it? Maybe you had passive loss limitations?

You’ve shifted tax into higher-rate buckets. Was it worth it? Is it worth it depending on exit thoughts?

You may have less capital gain treatment and way more ordinary income treat ment than you expected and that is algebra of the highest degree but you did cast some capital appreciation into bonus depreciation.

It’s not a dealbreaker. But it is a detail. Know the facts.

Most Realtors will hype bonus depreciation.

Very few understand what happens when you actually sell.

Even fewer understand what happens if you never can benefit monetarily or in life with enjoyment.

Learn about it and talk to qualified people and the most qualified would be a TAX Attorney that was once a field officer for the IRS!!

And like all good deals, the devil is in the details.

😎 Coming Next in the Series…

Post 4: The STR Exception — Rental… or Business?

We’ll now zoom out and reframe everything:

Your short-term rental isn’t even a “rental activity” under the IRS code. It’s a business — and whether or not you materially participate may determine whether you even get to use the depreciation at all.