The Depreciation Trap: What Real Estate Influencers Won’t Tell You About STR Tax Strategy

Post 5: But You Didn’t Participate — The Passive Loss Trap

DISCLAIMER: While I can read the language of the text and my wife and I fall under the short term rental exception and material participation so our outcome might be different, I am not a CPA or Tax Attorney. Everyone's situation is different, but this is a review of tax law considerations that many laypeople assume apply—often without confirming with legal experts or tax advisors.. Before assuming you are making a good financial decision using much discussed tax strategy in real estate, consult your advisors. The outcome is not always as a simple mind would want to believe. Again, this is not tax advice—just an academic review of the written word.

📘 Post 5: But You Didn’t Participate — The Passive Loss Trap

🎣 The Trap Is Set

Let’s assume you followed the first half of the playbook:

You bought a vacation home

You made sure it qualified as a short-term rental (under 7-day average stays)

You did a cost segregation study

You took $200,000 in bonus depreciation

Your tax return shows a giant paper loss

And you thought: “Nailed it.”

But there’s just one problem:

You didn’t materially participate.

📉 What Happens When You Don’t Participate?

If you don’t meet the IRS’s material participation tests, then your STR — even though it’s not a rental — is still treated as a passive business activity under IRC §469.

And here’s the rule:

Passive losses can only offset passive income.

If you have no other passive income (from other rentals or passive partnerships), then:

❌ You can’t deduct the loss.

❌ You can’t use it against W-2 income.

❌ You can’t use it against capital gains.

❌ You can’t use it against your spouse’s business income.

The loss becomes a suspended passive loss — carried forward year after year, until you either:

Generate enough passive income to absorb it, or

Sell the property in a fully taxable transaction

🪤 Bonus Depreciation… That You Can’t Use?

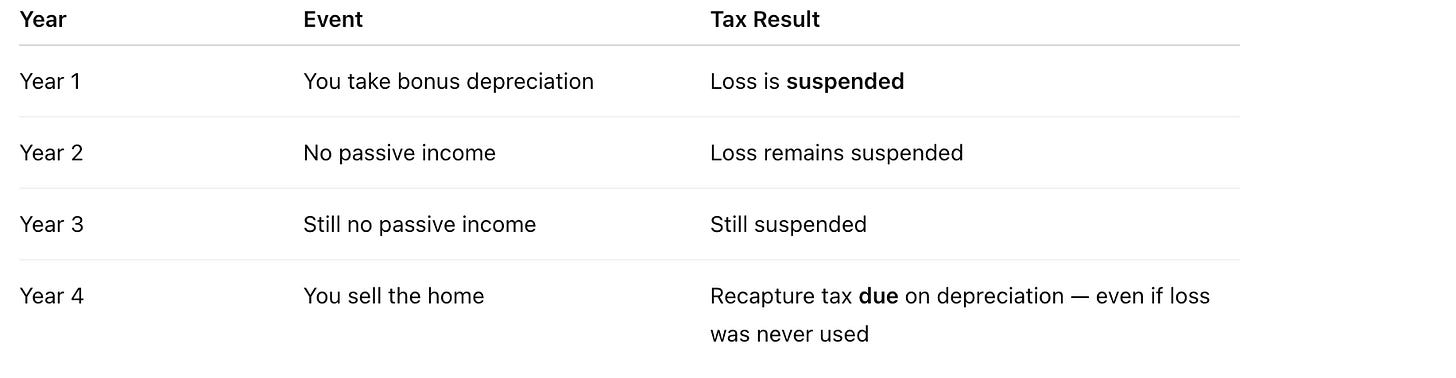

Let’s say your STR generated a $180,000 paper loss thanks to bonus depreciation in year one.

If you didn’t materially participate, that entire loss is locked.

It carries forward.

It sits there.

You don’t get all of the deduction. It is parceled out year after year with limitations.

But remember:

❗You still owe recapture tax when you sell — even if you never used the deduction.

That’s the trap.

🧠 Material Participation: The Gatekeeper

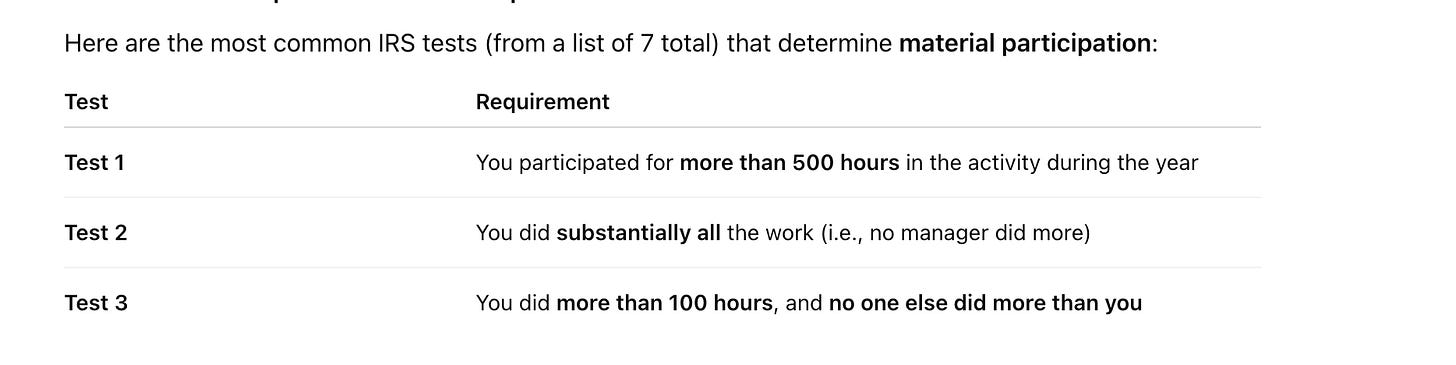

Here are the most common IRS tests (from a list of 7 total) that determine material participation:

If you don’t meet at least one of these, your STR activity is passive by default — and so are your losses. There is another more popular test for professionals in other fields like Doctors. The “appearance” of material control. Tightly controlled rental agreements that do not give any authority of substance to the rental manager and other factors can help on the 100 hours rule and there are other ways but each gets riskier and Cost Segregation is now a known audit flag among IRS field auditors.

😬 But Here’s the Catch

Most STR owners:

Use property managers - be careful of the language of the contract.

Outsource booking and guest communication - Don’t allow this

Think visiting the home, answering a few emails, and “being the owner” counts

It doesn’t.

The IRS requires actual hours of active involvement in:

Managing the rental

Handling guest issues

Making pricing decisions

Organizing cleaning and turnover

Marketing

Performing maintenance

You must be able to prove your participation if audited.

That means keeping logs.

This is not the honor system.

🔒 The Outcome

If you fail the test, here’s what happens:

📌 Summary: Participation Is the Unlock

Bonus depreciation only helps you if the IRS agrees you were active enough to use it.

This is where STR tax strategy dies for most casual investors.

If you don’t materially participate, then depreciation deductions become suspended losses — and all you’ve really done is defer pain.

You don’t get the cashflow relief.

But the IRS still gets its pound of flesh when you sell.

😎 Coming Next in the Series…

Post 6: But Then You Sell — How Suspended Losses Are Finally Freed. But if you 1031 again and again without passive income…..not just yet….

The good news? There’s a release valve.

If you sell the entire property in a fully taxable transaction to an unrelated party, you can unlock and use all those suspended passive losses — even against W-2 or ordinary income.

It’s the cleanest exit in the game. We’ll walk you through it next.