The Depreciation Trap: What Real Estate Influencers Won’t Tell You About STR Tax Strategy

Post 6: But Then You Sell — How Suspended Losses Are Finally Freed

DISCLAIMER: While I can read the language of the text and my wife and I fall under the short term rental exception and material participation so our outcome might be different, I am not a CPA or Tax Attorney. Everyone's situation is different, but this is a review of tax law considerations that many laypeople assume apply—often without confirming with legal experts or tax advisors.. Before assuming you are making a good financial decision using much discussed tax strategy in real estate, consult your advisors. The outcome is not always as a simple mind would want to believe. Again, this is not tax advice—just an academic review of the written word.

📘 Post 6: But Then You Sell — How Suspended Losses Are Finally Freed

🔐 So You Couldn’t Use the Deductions… Now What?

Let’s say you’ve been following this series and the light bulb finally went off:

You took bonus depreciation

You didn’t materially participate

Your CPA let the loss carry forward

You’ve been staring at a growing passive loss carryforward each year

You know it is not all bad news

You’re not alone.

This is one of the most common STR tax patterns out there. The good news is — there’s a door out of the trap.

See this Home. An Iconic Home In Seaside, Florida Representing the future is now Pending to a new owner. We were proud to create this vision. What’s Next?

💥 IRC §469(g)(1) — The “Trigger Event” Rule

The IRS allows you to release all suspended passive losses if you sell the entire interest in the activity in a fully taxable transaction to an unrelated party.

And when that happens?

All those suspended passive losses become fully deductible — against any kind of income.

💡 Translation:

You don’t need to materially participate anymore

You don’t need other passive income

You don’t need a 500-hour logbook

You just need to sell the property — cleanly.

And when you do, every prior year’s paper loss becomes usable against ordinary income — W-2s, business profits, consulting fees, dividends — it’s all fair game.

🔁 The Right Kind of Sale

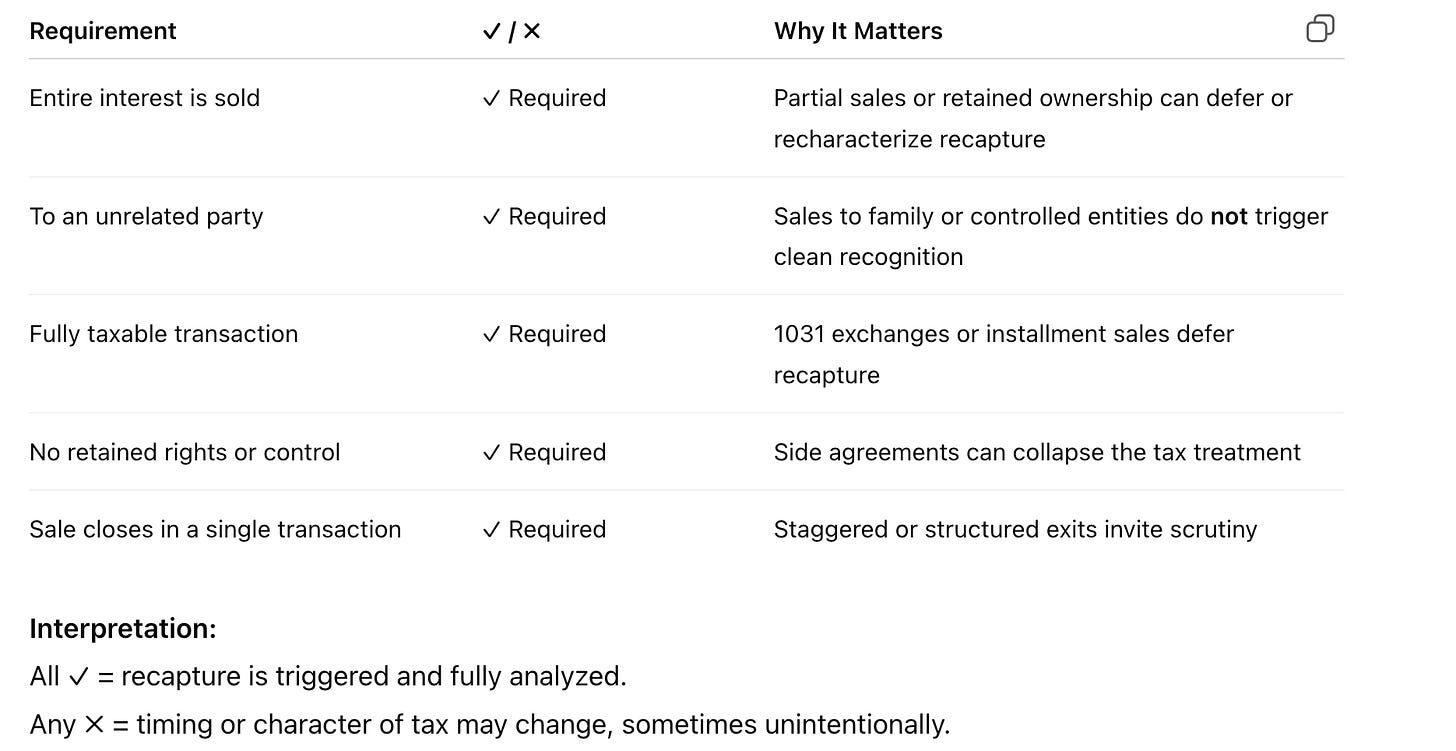

To qualify for the full release of suspended losses, your sale must meet three tests:

Do it right, and you unlock the entire pile.

🧮 Real-World Example

You bought a $2M STR in 2021. You took $200,000 in bonus depreciation but didn’t materially participate.

You never used the loss — it just carried forward

You now have $200,000 in suspended passive losses

You sell in 2025 for $2.6M in a fully taxable sale

In that year:

You’ll pay recapture tax on the depreciation

But you’ll also be able to deduct the entire $200,000 suspended loss — against anything

If you’re in a high-income year, that deduction could save you $74,000 or more in real taxes.

😏 The Irony

You didn’t get to use the deduction when you took it.

But now — after the sale — you get to use it right when the check clears. This is a math issue then. Did this work? Was it worth it to not really get benefit until much later? Maybe. Maybe not. Remember: Material Participation is really the key but what does that get you? Future Posts.

Is that perfect tax planning?

No. But it’s a win you can take advantage of if you know the rulebook.

🧠 Strategic Insight: Don’t Let Passive Losses Die in the Books

If you’re planning to sell a property where passive losses are suspended, make sure:

You sell the whole thing

You don’t 1031

You don’t do a partial LLC transfer

You don’t carry paper back

You trigger a clean taxable event

And suddenly, all those “useless” deductions become very useful.

📌 Summary: Selling Is the Unlock

Suspended passive losses can haunt your tax returns for years.

But a clean, fully taxable sale of your STR can unlock those losses all at once — and give you real savings against real income.

Passive losses are not lost. They are just waiting.

The question is: will you exit cleanly enough to claim them?

🧩 Coming Next in the Series…

Post 7: What If You 1031 or Never Sell? The Forever Hold Strategy and the Estate Step-Up

What if you never plan to sell? What if you want to defer everything forever — or hand the property off to your heirs?

We’ll close the series by breaking down the long play: 1031 exchanges, the step-up in basis, and why some depreciation really can disappear… if you die right.