You Deserve Better Representation Right?

A Fairer Framework for Agency

I work under a brokerage, and I understand the Exclusive Buyer Brokerage Agreement (BBA) is commonly used and encouraged. It is not the only way to comply with the NAR rules, but in some states the state law does not require either of these agreements. NAR requires is. Florida state law does not require BBA…your state might. But NAR does if your brokerage is a member of NAR. I recognize that different perspectives exist—some see it as essential protection, while others question whether its language goes too far. Both viewpoints deserve respect.

Here’s my take: the current BBA emphasizes enforcement over equity. Let’s explore how we can shape it toward fairness—protecting actual work while preserving client autonomy. Is it so bad to believe that the best BBA that can exist is your integrity and the fact that people would actually like your service and integrity and not need paper to work with you?

The Conditional Cancellation Trap

The Florida BBA states: “At Consumer’s request, Broker may agree to conditionally terminate this Agreement…”

That means:

The buyer must get the broker’s approval to exit—and may still owe a cancellation fee. Very important and you should be aware of this before signing. Does that make you feel good?

The broker, however, may resign freely. Would you like the same option? But your reason has to be of high integrity too.

Let’s see if we could solve this imbalance more fairly—by protecting deliverables, not enforcing loyalty.

Estrangement and Alienation: The Missing Escape Valve

NAR recognizes that relationships sometimes break for valid reasons:

Estrangement → no follow-up, communication lapses. What do you do then if the agent “ghosts” YOU!?

Alienation → behavior destroys trust (offensive or unprofessional conduct). I have seen this in action. Indeed I have experienced it where a client actually alienated me with a comment I found to be extraordinarily out of bounds. I learned the hard way — when a client crosses a cultural or ethical line, the only professional move is to resign the relationship immediately.

Yet the BBA does not reference these. That means even if the relationship is over, the contract persists—unless a reluctant broker agrees to release the buyer. That feels like protection of paper, not people. What can we do better?

Spotlight on Implied (and Oral) Agency: The Elephant in the Room

Implied agency means that if an agent behaves as though representing a client—even without signature—the law may recognize that relationship. Florida courts clearly allow for oral brokerage agreements to be valid and enforceable, particularly in procuring cause disputes, as long as the agent can prove their work led to the sale.Business Trial Group Still many firms miss the point of what is actually being protected. It is really not agent misbehavior. The protection is in Buyer and Seller Client misbehavior. That is what led to these agreements. The NAR Ethics rules take care of agent behavior….of course that relies on core integrity. More on clients and what we really want to protect.

So the industry’s discomfort with implied agency isn’t due to weak legal footing—it’s often about fear of client behavior or even worse other agents interfering, not legality.

That suggests we need better training and more disciplined client screening—rather than longer contracts. We also need to, and we get it, more trusted relationships with agents. There are agents here on 30A, our luxury market, that I know have my back as I have theirs. There are other agents that the whole community of agents avoids if at all possible because we know they do not work in the trusted framework of respect and ethics.

On Fear vs. Integrity

The real estate industry—based on commission—is often packed with professionals anxious about income, willing to stretch ethics to get paid. Even if it risks their reputation later.Those who don’t operate from fear walk differently, speak differently, and deliver differently. They hold unwavering integrity—even when the paycheck isn’t coming.

But What About the Bad-Buyer Scenario?

Sometimes things go sideways:

You show a buyer 123 Main Street.

They like it.

The listing agent whispers (violating NAR Article 16): “Work with me directly—I’ll get you a deal.”

The buyer cancels and walks away.

Fair? Of course not. Happens, even in luxury markets like Alys Beach.

The real question:

👉 Would you keep working with a client willing to undercut your relationship?

👉 Or should we build better client selection processes?

Often, the answer is not “add harsher penalties,” but “raise your standards.”

Florida Law vs. NAR Policy

Florida law does not require buyers to sign brokerage agreements. Implied or oral agency relationships can be legally valid.Business Trial Group

But since August 2024, due to the Burnett v. NAR settlement, NAR mandates written buyer agreements before property showings. This is not state law—it’s a professional rule born of negotiation.Florida Realtors

So the BBA in Florida is a professional expectation, not a legal requirement. Courts respect implied agency but NAR still leans on paperwork.

What Should Be Protected?

The BBA should focus on protecting work—not forcing relationships:

If an agent introduces a property, that effort should be compensated.

If the buyer later buys via another channel, the presenting agent deserves recognition. The reason a buyer might do this, if a bad purpose, should certainly be protected.

Beyond that, both parties should be free to walk away.

That’s equity.

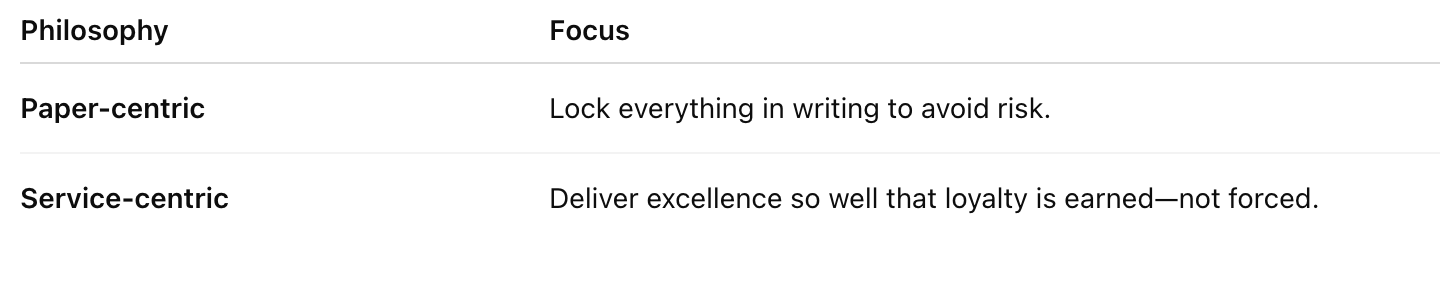

Two Philosophies at Play

Both exist. I lean toward the latter.

Bottom Line

Paper doesn’t build loyalty. Service does.

Let implied agency protect genuine work, and let clients move on when trust fades. Still NAR requires some agreement to work with Buyers. We prefer the showing agreement.

Because the strongest agents don’t fear cancellation. They fear failing their client.